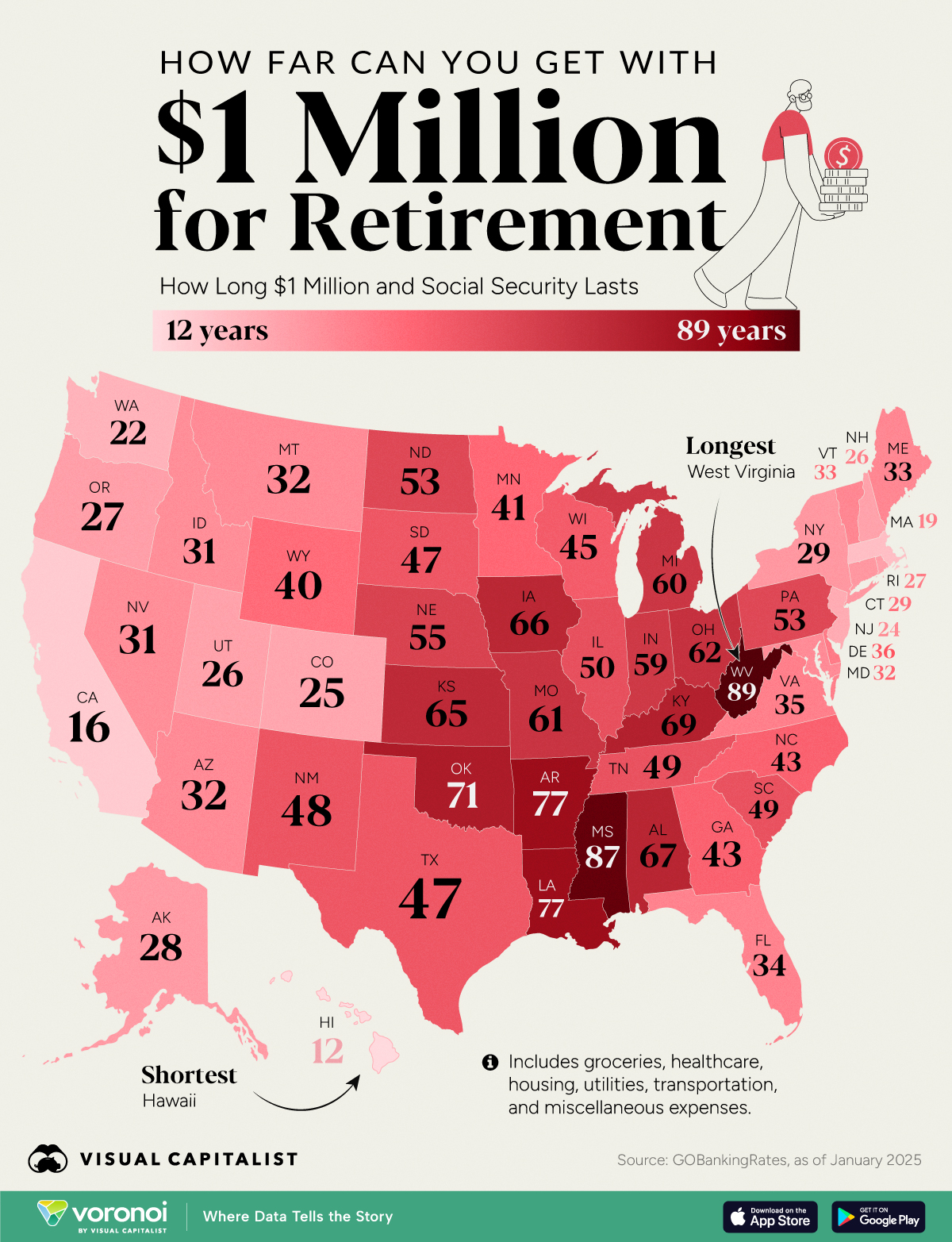

A million dollars is, for most of us, a lot of a money — but in some states across the US, a nest egg of that size wouldn't cover even 20 years of retirement.

Using analysis by GOBankingRates, Visual Capitalist mapped the number of years $1 million, combined with Social Security benefits, would last retirees in each US state.

A retirement pot of $1 million goes the furthest in West Virginia, where, along with Social Security, the amount would last 88 years.

There are four other states where the same amount could see residents through more than seven decades of retirement: Oklahoma (71 years), Louisiana (76 years), Arkansas (76 years), and Mississippi (87 years). In these states and West Virginia, retirees would need less than $1,200 a month after Social Security to cover living expenses.

Someone retiring in Hawaii would burn through a million dollars in just 12 years, while the same savings would only last 16 and 19 years in California and Massachusetts, respectively.

Nationwide, there are 36 states where $1 million plus Social Security is enough to retire for at least 30 years.

Click image to enlarge

Via Visual Capitalist.